QuickBooks has a wide network of banking partners, making it easy to securely import your bank feeds from a variety of banks and credit card companies. This seamless integration saves time, ensures accuracy, and eliminates manual errors. QuickBooks’ user-friendly interface makes navigating your finances a breeze, even if you’re not an accounting expert. The layout and simple design ensure that you can find what you need quickly and efficiently. To review this software, I signed up for a free trial of the Xero Established plan. I also reviewed official product documentation, watched demo videos, consulted user reviews and cross-referenced software reviews in industry publications.

- Higher-tier plans include unique features, like workflow rules, on top of tools that help you measure project profitability.

- QuickBooks Online is an industry standard with more than 5 million users worldwide.

- Katherine Haan is a small business owner with nearly two decades of experience helping other business owners increase their incomes.

You can receive automated bank feeds into your accounting software and connect to other business apps for greater efficiency. You can also collaborate with other people, like accountants and bookkeepers, by giving them access to view and share your figures. Xero regularly backs up your data and protects it with multiple layers of security.

Click the « OK » icon between the two to verify the match is correct. We believe everyone should be able to make financial decisions with confidence. From streamlined bank connections to intuitive online invoicing, Xero’s features empower you to prioritize business growth. Simplify your finances and get more done with Xero online accounting software. Another key difference between the two companies is the maximum number of users it allows. Xero has no limit to how many users can access data, whereas QuickBooks limits this to 40 with its Enterprise plan.

Overall features

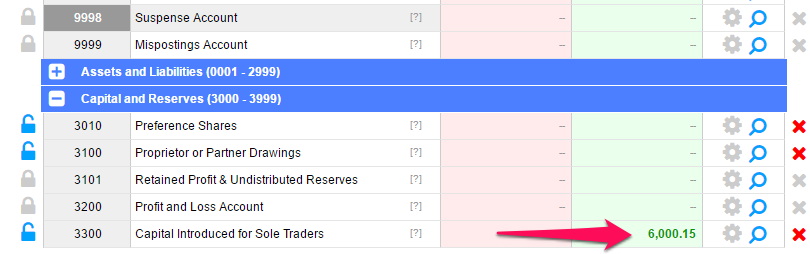

For example, you can give all employees the ability to send quotes and invoices, allow some to enter expenses and limit who can see the company’s complete financial picture. To keep things organized, Xero logs every action users make and compiles the history of every transaction. When reconciling books, Xero suggests likely matches between bank statement lines and transactions entered in the software. For example, if you have an entry for an invoice of $1,000 and a recent $1,000 deposit in your bank account, it might suggest matching these two transactions.

We compared the two options in terms of their key features, pricing and customer service to help you decide which is right for your business. Xero, FreshBooks and marginal revenue definition example and formula QuickBooks all offer 30-day free trials and extensive features for online support, including a live chat, email support and a knowledge base. All three of these offer the ability to scale their accounting for larger businesses and both Xero and QuickBooks offer specific training for accountants. These companies offer Gusto integration for the same price—$40 per month and $6 per month per person. On the other hand, FreshBooks may be a better fit for freelancers and solopreneurs, as the capabilities are easier to navigate.

Xero Accounting app

Xero’s unlimited-users feature makes it a winner among larger businesses and well-established small businesses that require more than five users. It’s also less expensive than QuickBooks Online and a bit easier to use, thanks to its customizable dashboard and simple layout. It’s easy to see why QuickBooks is a standout choice for small-to mid-size businesses. Its intuitive interface, robust feature set, and readily available customer support make it a comprehensive and user-friendly solution designed to help grow—and scale with—your business. All of your bank and credit card transactions automatically sync to QuickBooks to help you seamlessly track your income and expenses.

Best Accounting and Bookkeeping Apps for Small Businesses

We’re upfront about pricing, and provide full details of our pricing plans and optional extras. Where a feature is listed as an add on (like Xero Payroll, Xero Projects, Xero Expenses and Analytics Plus), its pricing depends on the number of users who use the add on each month. QuickBooks offers a mobile app for both iOS and Android devices, allowing you to manage your finances and your business on the go. You can create and send invoices, track expenses, reconcile bank accounts, and more, all from your smartphone or tablet.

Get customer support

The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. FreshBooks offers unlimited time-tracking in its lowest-tier Lite plan, whereas Xero users would have to opt into the highest-tier Established plan for that feature. Xero doesn’t provide a phone number on its customer support page, but a representative will call you if necessary. This is a serious drawback if you want to be able to pick up the phone and talk through an issue or are new to accounting software and have lots of questions. Xero lets new customers sign up for a 30-day free trial to test out its features.